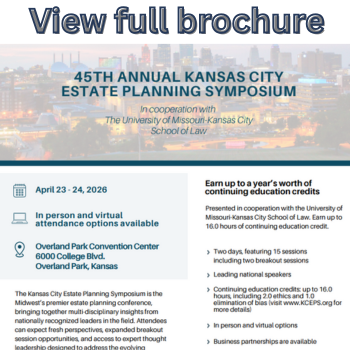

4/23/2026 - 4/24/2026

KANSAS CITY ESTATE PLANNING SYMPOSIUM

Sponsored by the Kansas City Estate Planning Symposium in cooperation with the University of Missouri – Kansas City School of Law

Thursday and Friday, April 23-24, 2026 | Overland Park Convention Center | 6000 College Boulevard | Overland Park, Kansas

The Kansas City Estate Planning Symposium is the Midwest’s premier estate planning conference, bringing together multi-disciplinary insights from nationally recognized leaders in the field. Attendees can expect fresh perspectives, expanded breakout session opportunities, and access to expert thought leadership designed to address the evolving challenges and strategies in estate planning. Participants can earn up to 16 hours of continuing education credit while engaging in real-time dialogue with speakers and peers. With a variety of intentional networking opportunities, the Symposium offers a unique platform to build meaningful relationships, exchange ideas, and strengthen professional connections within the estate planning community. Sharpen the professional skills that will help you enhance your career and better serve your clients and organization. The Kansas City Estate Planning Symposium offers timely and relevant information for every person engaged in estate planning:

- Estate Planning Attorneys

- Business & Tax Attorneys

- CPA’s

- Trust Officers

- Planned Giving Professionals

- Financial Planners

- Life Underwriters

Continuing Education Credit:

- Earn up to 16.0 hours of continuing education credit. Click HERE to view the Credit Summary.

Registration Fees:

- $550.00 (two day conference with digital course materials) - virtual registration options are available. Register by April 20th for in-person attendance.

- $500.00 (single day attendance with digital course materials) - in person attendance only - this option is not available for virtual attendees

Lodging:

There are several hotels in the immediate area of the Overland Park Convention Center, many within walking distance. The Overland Park Sheraton is connected by a walk-way to the Convention Center. Click HERE to view the list of nearby hotels.Location: Overland Park Convention Center

6000 College Boulevard

Overland Park, KS 66211

4/30/2026

Location: Lathrop GPM LLP

7300 West 110th Street, Suite 150

Overland Park, KS 66210